The Missing Piece of Your Tax Team. Bookkeepers record.

CPAs file. We review what everyone else

forgot to check.

Most people assume once a return is filed, the story is over. In reality, that’s often when

hidden opportunities

remain untouched. Your bookkeeper keeps the numbers tidy. Your CPA prepares and files your

returns. But no one

goes back to see if that return could have been optimized.

🔒 We automatically remove name, SSN before analysis

🧾 We only use your return to generate your report

❌ We never sell your data

The real reasons to let us analyze your returns

Forget the compliance theater. Here’s why our AI actually delivers results that make your accountant jealous.

Patent Pending AI System

Purpose-built for tax optimization, not repurposed marketing fluff.

Rich People Tax Advice for $49.99

Fortune 500 strategies democratized through AI. Why should only rich people get rich people tax advice?

IRS Security Summit Compliant

We follow IRS guidelines + enhanced privacy protocols. Your data gets analyzed, then vaporized.

Reports That Actually Matter

Dollar amounts, risk assessments, and step-by-step implementation guides you can act on.

How Our AI Finds Hidden Tax Savings

Every tax return flows through our secure AI analysis engine — parsing hundreds of fields, cross-checking IRS logic, and revealing missed deductions most filers overlook.

Why We’re Not Your Typical Data-Harvesting Platform

We’re IRS compliant, CPA overseen, and designed to leave no footprint.

IRS Compliant

SOC 2 Type II pending. Built to meet federal standards by design.

Privacy is Our DNA

No emails, no marketing lists, no harvesting. Just results.

Zero Permanent Footprint

Your data is analyzed then self-destructs. Nothing to hack, nothing to steal.

Explore the What-If Lab

Adjust your 401(k), HSA, IRA contributions and instantly see your tax savings. Test scenarios with our interactive tool after processing. Apply your savings and play with options.

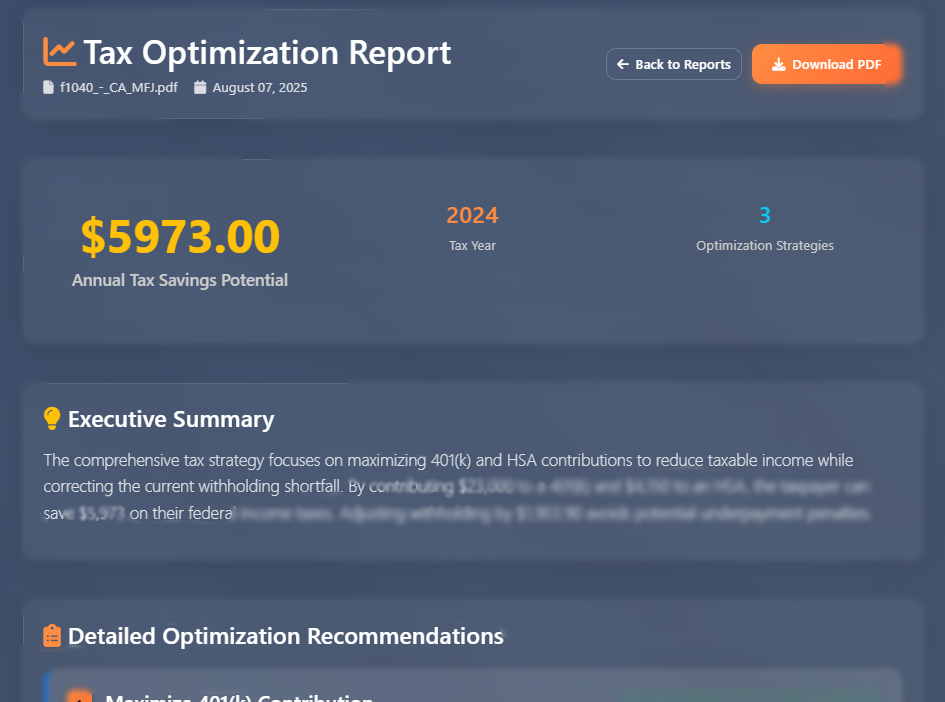

Preview blurred for privacy — full interactive lab unlocked after your analysis.